Lisett Luik, Co-founder, COO

Afforestation carbon credits in numbers

All underlying data courtesy of the Berkeley Voluntary Registry Offsets Database v7, published in February 2025.

For all this talk about afforestation and how it could grow – have you ever wondered how big the market already is, and where the bulk of the projects are? If so, read on for the key numbers you should know.

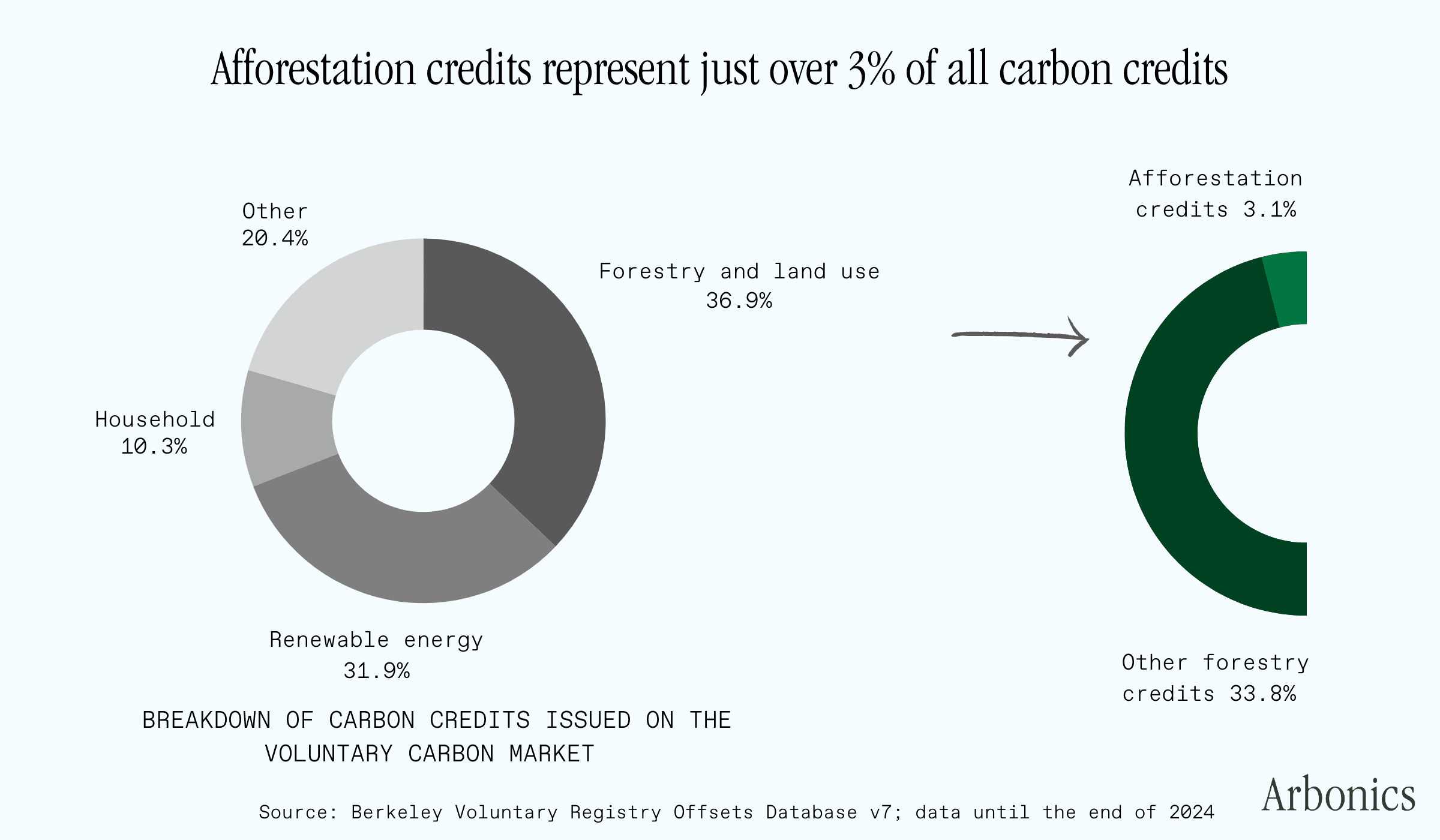

How do afforestation carbon credits fit into the broader market?

Afforestation is just one type out of a range of carbon projects, accounting for just over 3% of all carbon credits issued:

Are all these projects developed according to the same rules?

Not entirely - there are different types of afforestation projects based on various methodologies (a methodology is just a set of rules for how the project should be operated).

The biggest afforestation methodologies currently used in the market are managed by Verra (read more about Verra and its role in the voluntary carbon markets here).

They are usually referred to by the rather un-catchy code names AR-ACM003, AR-ACM001 and VM0047 (you can read the methodologies on the Verra website, but be forewarned, it is rather dull reading!). Between them, these three methodologies account for 45 million afforestation carbon credits issued (/tonnes of CO2 stored – roughly equivalent to the annual CO2 footprint of almost 10 million Europeans, or the entire country of Serbia). That represents 63% of all afforestation carbon credits issued, ever.

Verra recently made updates to it’s afforestation methodologies, consolidating all afforestation methodologies under the newest VM0047, which was released in 2023. As a result, AR-ACM003 is no longer available for project developers.

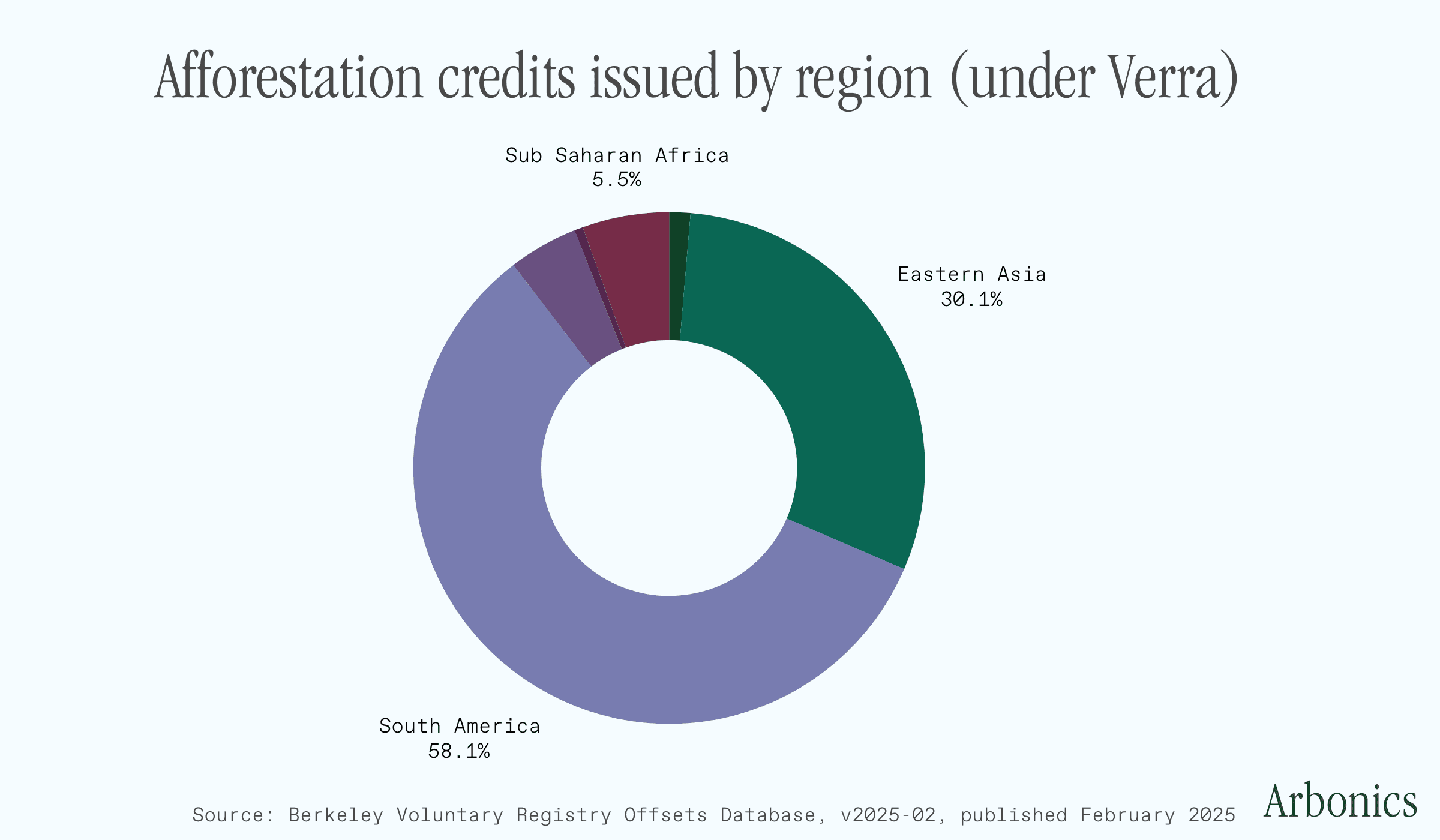

Who is planting all the trees and generating the afforestation carbon credits?

In April 2025, under these methodologies, there were 384 afforestation projects listed in the Verra registry, of which:

- 60 were inactive, rejected (including one Europe-based project) or withdrawn

- 84 had already issued at least some credits (remember that it can take 5 years for afforestation projects to start issuing carbon credits!)

- and 251 were under development (Arbonics is one of these)

Of all 45 million afforestation carbon credits issued under Verra so far, the majority were generated in South America and East Asia:

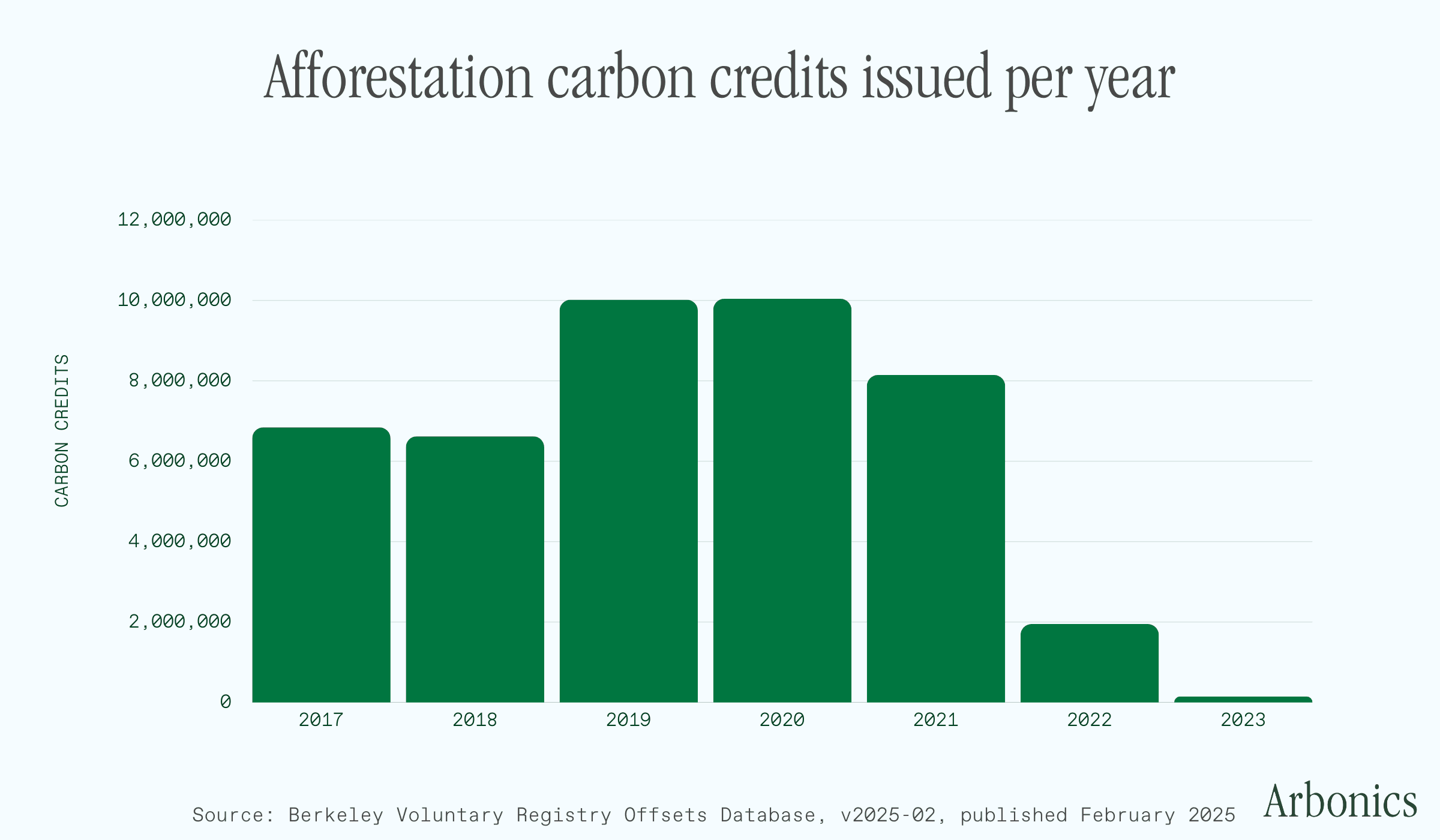

Does that mean the market supply is growing rapidly?

Yes, growing - but not rapidly. Across all registries, you can see the 2021 and 2022 issuances of credits are still lower than 2020 issuances. This suggests a lack of high-quality afforestation carbon credits entering the market but also delay in getting credits issued, as trees will take time to grow.

Credits are usually issued in vintages, once verification takes place, the year in which carbon was sequestered is attached to the vintage, e.g. if we do the first measurement/verification of trees planted 5 years ago, we might attach 5 different vintages to these credits.

How big is the afforestation carbon credit market in dollars/euros/yens?

All this talk about the number of credits generated may lead you to ask – okay, but what is the actual value we’re talking about here? On this, it becomes much harder to find solid data.

However, we can take an educated guess: from our experience, afforestation carbon credits are currently selling for a broad range of prices, from $20 (generally older vintages and/or lower-quality projects with non-native species or low permanence) to as high as $70/tonne (very high-quality credits).

Using these as an indicator, the market value of the 2021 vintage ranges from $163M to $570M, and the 2022 vintage from $39M to $137M. While these numbers may not be huge, a few key things to keep in mind:

- Demand in the voluntary carbon market more broadly has increased by nearly 4x over the last couple of years and is likely to continue increasing

- Afforestation carbon credits are one of the few removal-type credits available on the market today at scale – as a result, while supply has been lagging, demand has grown significantly.

- Prices for carbon credits more generally are expected to increase even more by 2035 – read more in our overview of carbon credit pricing here.

For more on the voluntary carbon markets and afforestation, please see our Knowledge Hub. In particular, you might find this primer on carbon credits handy, or else want to dig more into how the voluntary carbon market works.

If you are ready to jump in and think you have suitable land - get in touch here!

Arbonics connects landowners and credit buyers at scale to remove carbon and protect biodiversity through data-backed forestry solutions.

Our leading technology finds the best strategies to maximise carbon removal, allowing us to offer two solutions to landowners: Afforestation for planting new forests, and Impact Forestry for improved forest management.

We provide credit buyers with high-quality carbon credits from these projects to support your positive environmental impact. Our solutions are backed by advanced technology, deep forestry expertise, and the stringent forestry regulations of the EU.

Interested in buying credits? Introduce yourself here and we will be in touch! Follow us on LinkedIn, Facebook, and Instagram for latest news.

- How do afforestation carbon credits fit into the broader market?

- Are all these projects developed according to the same rules?

- Who is planting all the trees and generating the afforestation carbon credits?

- Does that mean the market supply is growing rapidly?

- How big is the afforestation carbon credit market in dollars/euros/yens?