Carbon offtake agreements: the approach leaders are taking

Key takeaways

- Offtake agreements help you lock in a steady, predictable supply of high-quality carbon removal credits - especially important as demand for these projects grows

- With carbon credit prices expected to climb significantly over the next decade, offtake agreements allow you to hedge against increases over the long haul

- Choosing reputable carbon project developers ensures transparency and delivers benefits beyond carbon, like biodiversity conservation and community impact

The growing push to meet climate goals is bringing more companies into the carbon market, and it's a sign of real progress. But with demand rising, high-quality carbon credits will become harder to secure. That’s because truly impactful projects - the kind that deliver real, measurable carbon removal - take time to develop. And soon, there simply won't be enough of them to meet growing demand.

That’s where carbon offtake agreements come in handy, helping companies lock in long-term access to high-quality carbon credits and protecting them from future supply shortages as demand rises.

But how exactly do they work? Let’s take a closer look.

What are carbon offtake agreements?

Let’s kick-off with the basics. A carbon offtake agreement is a long-term contract between a buyer and a project developer where the buyer agrees to purchase a specific amount of carbon credits over multiple years at fixed or variable pricing.

A quick overview of the process:

- A project developer creates a nature-based or engineered carbon removal project

- The project is verified and validated by independent standards, like Verra’s VCS or Gold Standard

- The buyer and the project developer sign a contract that outlines the final agreed-upon terms on volume, pricing model, and timelines

- Once the project begins, verified credits are issued to the buyer as per the delivery schedule

- The buyer retires the credits in a registry to indicate the impact has happened and prevent double counting

So what’s the difference between carbon offtake agreements and other credit purchases?

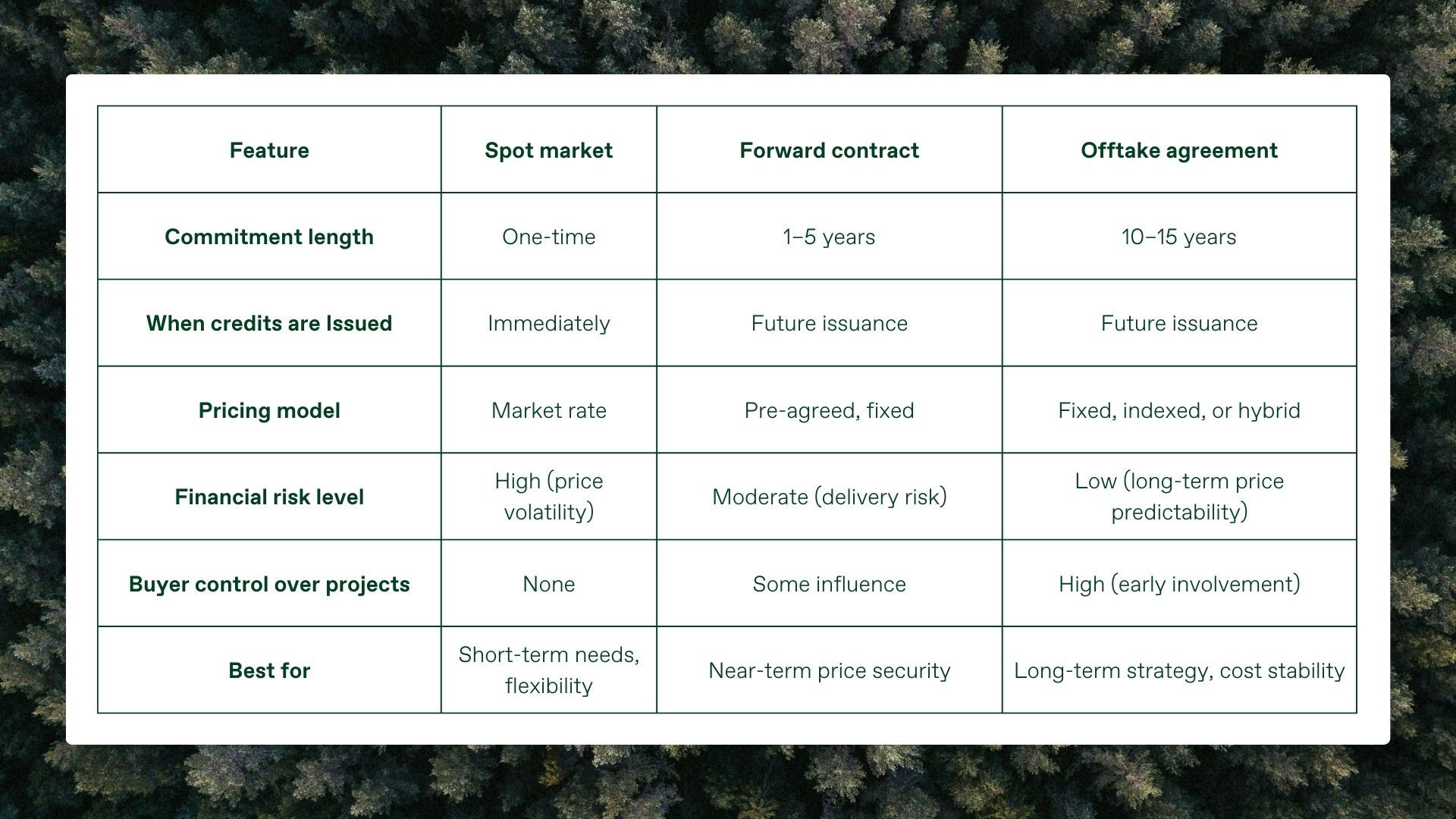

Offtake agreements are one of three main ways to buy credits in the voluntary carbon market. You can also purchase credits from the spot market or via forward contracts.

Spot purchases, as the name suggests, are procured ‘on the spot.’ They offer flexibility and instant access to available credits, making them ideal for meeting immediate needs. But since you're buying what's available right now, prices can change quite a bit depending on supply and demand, so it's not always the most predictable option.

Forward purchases let you secure a set number of credits for future delivery, usually in the near term. You pay upfront, which means you’re protected if prices increase later on. However, they carry risks: projects may underdeliver on volume, timing, or credit quality, and if market prices drop before the credits are retired, you could end up paying more than their actual value.

Carbon offtake agreements work a little differently. They’re long-term contracts where you commit to buying a set amount of credits on a regular schedule, monthly or yearly (depending on the contract). Instead of a one-time deal, it’s a steady, ongoing supply, often with phased payments. This setup gives you more predictability and lets you build a lasting relationship with the project developer. It’s a solid option if you're thinking long-term and want to be more hands-on in how your credits are sourced.

Here’s a handy table that breaks down the key differences between the three.

Why are more carbon buyers choosing offtake agreements?

Between 2021 and 2023, demand for high-quality carbon removal credits grew fivefold - yes, fivefold - according to Carbon Direct. While these numbers reflect forward and spot transactions, they also show us that buyers are prioritising quality.

What has this got to do with carbon offtake agreements? Let’s get into it.

Secure high-quality credits

The reality is, most credits on the market today still fall short on quality, and the few that meet a higher bar are often the first to go. What this means for buyers is simple: access to high-quality credits is becoming more competitive. As the market matures, companies looking for high-integrity carbon credits need to move earlier to secure supply, or in other words, leverage carbon offtake agreements.

Hedge against price increase

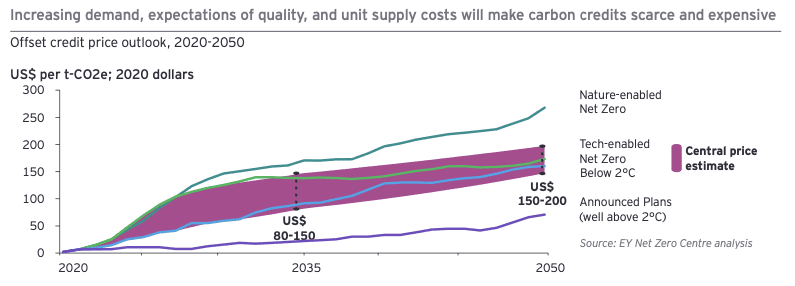

High-impact carbon removal projects, especially nature-based solutions (think: afforestation, reforestation), take years to develop. Trees planted today will take 7-10 years to grow faster and reach their full potential for carbon sequestration. So if we want to hit climate targets before 2050, we need to plant forests now. But with demand rising and high-quality supply limited, prices are already increasing.

We’re already seeing signs of where things are headed: EY’s Net Zero Centre Analysis predicts carbon credit prices will reach $80-150 per tCO2e by 2035. By committing to a carbon offtake agreement, you guarantee access to future credits at pre-agreed prices, effectively shielding your climate strategy from price hikes and potential supply shortages as demand grows.

EY’s Net Zero Centre analysis expects prices to be in the range of $80-150 per tCO2e by 2035

EY’s Net Zero Centre analysis expects prices to be in the range of $80-150 per tCO2e by 2035

What’s been happening in the market for carbon offtake agreements?

Here’s a quick round-up of key trends in offtake agreements in 2025:

Market dominance by large buyers

For the reasons stated above, big players like Microsoft, Google, Meta, and Salesforce are entering into multi-year offtake contracts, fast and at a big scale. In fact, Microsoft alone is is responsible for over 50% of credit purchases in the market.

Take this, for example: in 2024, Microsoft signed a 20-year deal with BTG Pactual Timberland Investment Group (TIG) to purchase 8 million nature-based removal credits - the largest transaction of its kind to date.

Want to stay in the loop on what’s happening in the voluntary carbon market? Head over to our Substack, where we share monthly roundups of the latest news and insights.

Coalitions are forming

Tech giants Microsoft, Meta, Google, and Salesforce entered into an alliance to form Symbiosis Coalition in 2024. Its purpose? Secure up to 20 million tonnes of nature-based CDR credits by 2030. Its first-ever request for proposal (RFP) focused on reforestation and agroforestry projects.

Arbonics took part in the process. If you’re curious about how we approached it, Chantel Rowe, our Head of Technology, shares the details here.

More nature-based offtake deals

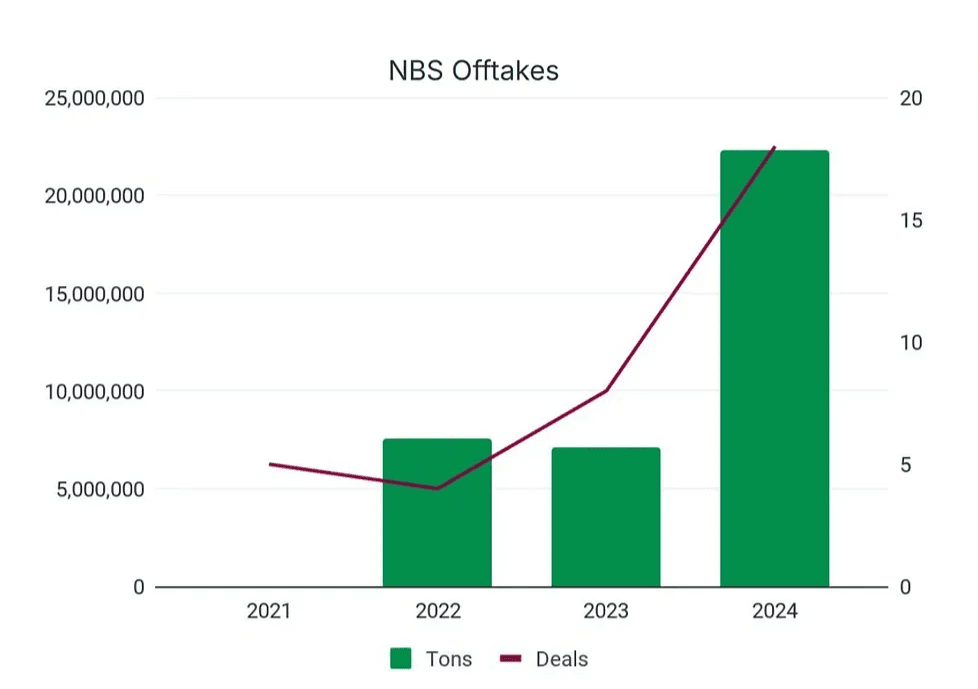

In 2024, carbon offtake agreements were used to secure more than 20 million nature-based solutions (NbS) credits— that’s about 10% of all market retirements. This trend of investing in early-stage projects instead of secondary market purchases is expected to grow in 2025, as buyers look to lock-in supply.

Figure 4: VCM 2024 Review & Emerging Trends for 2025 by Allied Offsets

Figure 4: VCM 2024 Review & Emerging Trends for 2025 by Allied Offsets

Looking to buy? How to convince your CFO that a carbon offtake agreement is a smart investment

If you're considering a carbon offtake agreement, you’ll already know that getting support from your finance team is an important part of the process. And that means addressing the big question: why not just buy on the spot market?

Spot purchases can seem simpler, but they’re becoming harder to rely on. As demand surges, high-quality credits are increasingly scarce, and the spot market simply can’t keep up. Carbon offtake agreements, on the other hand, offer:

- Stability in a changing market - avoid paying a premium later or having to rely on lower-quality options when supply tightens

- Long-term cost savings - use fixed or formula-based pricing to gain greater visibility into future credit costs, and have your agreement use safeguards like indexed pricing, which adjusts in line with external benchmarks

- Regulatory compliance - secure credits that align with recognised standards and ensure your organisation is well-positioned to meet regulatory requirements as they evolve in the years ahead

How to manage risks with carbon offtake agreements

The best way to lower risk is to choose a highly-rated, accredited carbon project developer. Much easier said than done, I know, but here’s a checklist of what to look out for.

Accreditation & verification

Look for recognised certifications such as Verra’s Verified Carbon Standard (VCS), Isometrics, and Gold Standard - they indicate that the project behind the carbon offtake agreement is credible. Their rigorous methodologies ensure that each credit can only be claimed by one organisation (no double counting!)

The Integrity Council for the Voluntary Carbon Market (ICVCM) recently introduced Core Carbon Principles (CCP) to raise the bar for quality. Carbon projects with CCP-eligible status are seen as especially high-quality - so keep an eye out for these too.

In fact, Verra’s VM0047 Afforestation, Reforestation, and Revegetation methodology meets the CCP’s assessment criteria, so any projects using it (including ours!) automatically carry CCP labels.

Track resilience

When exploring carbon offtake agreements, you want a developer that can clearly demonstrate they have the financial backing to secure the investment necessary to scale projects. A good sign is when the developer openly shares details about their methods, potential risks, and how they're managing them.

Another critical point is scientific expertise. High-quality carbon projects rely on deep know-how and experience in fields like forestry, geo-informatics, and environmental science. For example, at Arbonics, we collaborate with the brightest minds in geo-informatics and forestry to develop our projects.

Data transparency & MRV (Monitoring, Reporting, Verification)

High-integrity projects, which are essential for successful carbon offtake agreements, rely on technologies to track, monitor, and report project outcomes clearly and consistently- usually quarterly or at least annually. At Arbonics, we use 50 data layers and advanced models to map and monitor every project digitally at a granular level.

This enables us to provide buyers with full access to project data, which allows them to explore and verify the impact of their investment. You can learn more about our technology here: The backbone of Arbonics: understanding our technology.

Co-benefits

It’s important to assess the benefits beyond carbon sequestration. Consider it a big green flag if the project delivers co-benefits like biodiversity conservation and community development. This can go a long way in amplifying your impact on the environment and society.

Aside from the points above, here are some quick tips on how to avoid risk with carbon offtake agreements:

- Avoid exposure to drastic price increases or decreases through price collars where parties decide on minimum (floor) and maximum (ceiling) prices to buy and sell credits. Index-based pricing is another useful tool to hedge risk

- Instead of committing to a large upfront payment, a better idea would be to structure agreements with staggered payments. This will help your organisation maintain liquidity while also offering you financial flexibility

- Incorporate volume flexibility clauses that allow your company to adjust the quantity of credits you’re obligated to buy without breaching the contract. This ensures you have room to adapt as your climate strategy matures

Explore carbon offtake agreements with Arbonics

Choosing high-quality credits from reliable carbon removal projects doesn't have to be complicated or costly. At Arbonics, we're helping restore forests and biodiversity across Europe while connecting climate-conscious companies with trustworthy, nature-based carbon credits. Want to know how we can support your climate goals? Get in touch with our team here.

- Key takeaways

- So what’s the difference between carbon offtake agreements and other credit purchases?

- Why are more carbon buyers choosing offtake agreements?

- Secure high-quality credits

- Hedge against price increase

- What’s been happening in the market for carbon offtake agreements?

- Market dominance by large buyers

- Coalitions are forming

- More nature-based offtake deals

- Looking to buy? How to convince your CFO that a carbon offtake agreement is a smart investment

- How to manage risks with carbon offtake agreements

- Accreditation & verification

- Track resilience

- Data transparency & MRV (Monitoring, Reporting, Verification)

- Co-benefits

- Explore carbon offtake agreements with Arbonics