What is the voluntary carbon market?

What are carbon markets?

Before we dive into voluntary carbon markets, it’s important to note that there are two types of carbon markets:

- Voluntary carbon markets

- Mandatory (or compliance) carbon markets

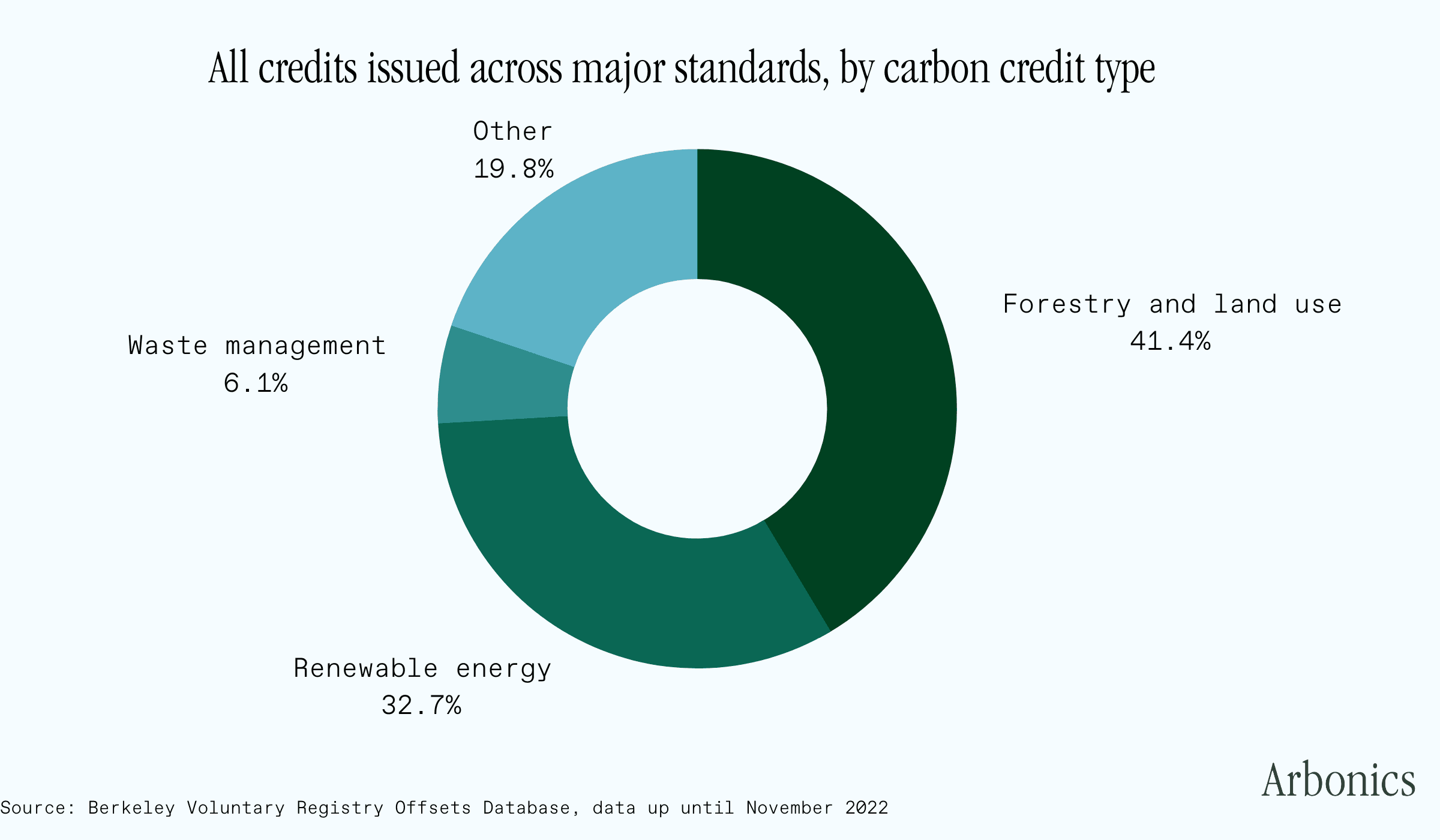

Voluntary carbon market gives individuals or organisations an opportunity to offset their emissions by purchasing carbon credits. Supply of carbon credits to this market comes from various carbon projects around the world, including from forestry.

Arbonics offers landowners opportunity to earn carbon income from the voluntary carbon market when they afforest their land. Sign up here to find out if your land is suitable for afforestation.

Compliance markets are regulated carbon trading systems that have nationally, regionally or internationally determined rules, and participants from heavy polluting industries (think steelworks or car manufacturers) The European Union Emissions Trading Scheme (EU ETS) is an example of a compliance market. In terms of volume, compliance markets are bigger than voluntary markets.

The total value of compliance markets adds up to around 760 billion EUR, compared to 2 billion EUR for voluntary markets.

This article will focus on the voluntary carbon market, which operates independently of compliance markets and is more easily accessible to land and forest owners. It is growing rapidly, with demand of credits expected to increase by a factor of 15 or more, with total market value expected to reach upwards of 50 billion EUR by 2030.

What is traded on the voluntary carbon market?

The voluntary carbon market is a trading system for exchanging carbon credits - units of reduction, avoidance or removal of greenhouse gas emissions. Sellers and buyers exchange credits on the market, and the carbon price is determined based on supply and demand dynamics. One credit (also referred to as an offset in some cases) usually represents one metric tonne of CO2 or equivalent greenhouse gas emissions (tCO2).

Why does this market matter for landowners and foresters?

Trees turn CO2 into solid carbon as they grow and act as a carbon store. This makes forests a highly effective nature-based tool for carbon removal. This carbon removal and storage can be measured, verified and turned into carbon credits by working with standard and verification organisations such as Verra and Gold Standard.

Forestry projects with the aim of generating carbon credits can take different forms including:

- afforestation - planting trees on a land previously not forested

- changing management practices to optimise for carbon storage

- turning forests into protected areas

The demand for these projects has been increasing as the need for nature-based solutions for carbon removal (and therefore carbon credits) increases. This demand is driven by corporations, who aren’t part of compliance markets, looking to reduce and offset the emissions they are responsible for. Motivated by various factors but mainly by consumer pressure for low carbon products and a wish to position their brand in the low-carbon space.

This demand for credits on the voluntary carbon market has allowed the price for carbon credits to increase, creating a strong monetary incentive to establish the sorts of projects mentioned above - such as afforestation.

Participating in the voluntary carbon market is a great opportunity for landowners, who can work with carbon project developers to unlock additional and more frequent revenue streams.