Lisett Luik, Co-founder, COO

What happened in the voluntary carbon market in 2022?

And what to look out for in 2023

All underlying data courtesy of the Berkeley Voluntary Registry Offsets Database v7, published in February 2023.

First, let's talk about...

Carbon credit issuances (i.e. new carbon credits generated)

Carbon credit issuance is a relatively simple concept - once a project has passed validation and verification and the activity that either removes CO2 from the atmosphere or avoids CO2 emissions has been proven, the relevant verifier/carbon standard issues credits (adds a line to its database). (For more on who verifiers/carbon standards are, see here).

Why care how many and what type of credits were issued in a year?

By looking at credit issuance, we can get a sense of the broader voluntary carbon credit market: which sections are growing, which are not, and how the overall market is trending.

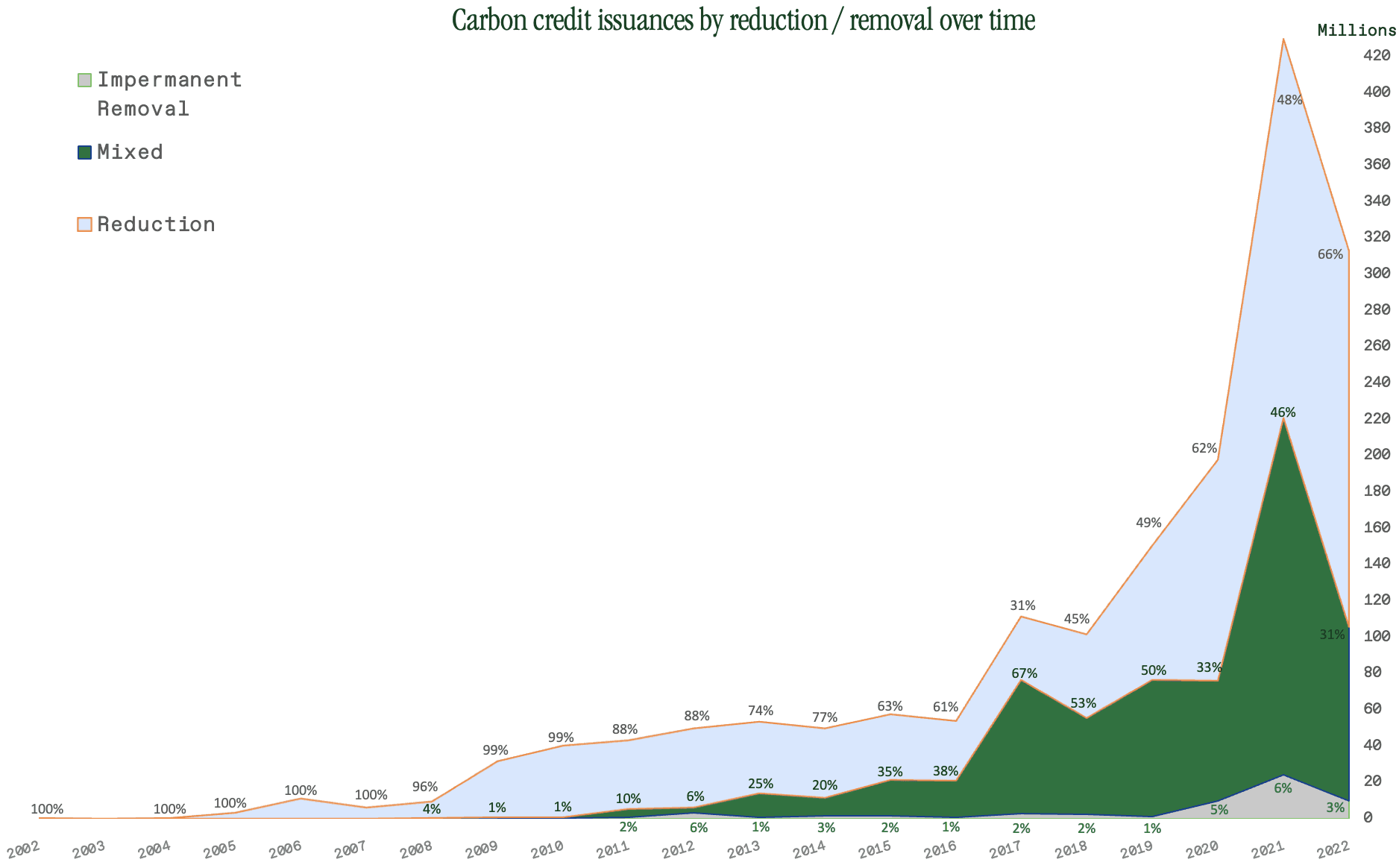

In 2022 we saw a small retrenchment from the issuance peak of 2021. The total number of credits issued grew over 100% from 2020 to 2021, and then declined around 35% from 2021 to 2022. However, despite this retrenchment, 2022 was overall still the second-highest issuance year in the history of the voluntary carbon market.

Carbon credit issuance by type and year; from the Berkeley Voluntary Registry Offsets Database v7

What’s interesting is looking at what drove the decline.

The largest proportion of carbon credits - reduction-type carbon credits (also referred to as avoidance credits) - stayed essentially at the same level as in 2021. These credits represent the cheapest and most controversial end of the voluntary carbon markets and frequently receive strong criticism. However, despite those headwinds, the issuance of these types of credits seems to have held steady.

Where we see a decline is instead in two other types of credits:

- removal (further separated into permanent/impermanent removal) - this is currently primarily afforestation

- mixed - this includes a lot of other land-use related projects, like forest management, wetland restoration and soil carbon

Why might these types of credits see a decline in issuance?

For impermanent removal, this is most likely due to a supply crunch. Afforestation takes a while before credits are issued, and in the early years of a project, credit issuance can fluctuate a lot year to year.

For mixed-type credits, the story is less clear - it may well be the case that some negative feedback for credits like avoided deforestation (known as REDD+ credits - more on the issues here) has led to a higher quality bar for credit issuance and therefore fewer credits issued overall.

What are carbon credit retirements?

You might be wondering - what is this “retirement” you speak of? Are carbon credits starting a vegetable garden or heading off on a cruise? No. Retirement is industry speak for credits getting used for their original purpose - to offset CO2. In very simple terms, it works as follows:

- a company or an individual buys credits equivalent to the unavoidable part of their CO2 footprint (after having made a concerted effort to reduce the footprint)

- these credits are then cancelled - “retired” - so that they can’t be used again, and the carbon credit is removed from the market

Looking at credit retirement rates in the voluntary carbon market tells us what proportion of carbon credits demand is coming from this main use (the other reason credits may get bought is to hold onto them for future, as a hedge against credit price increases). It is also a good proxy for demand more generally.

What happened to carbon credit retirements in 2022?

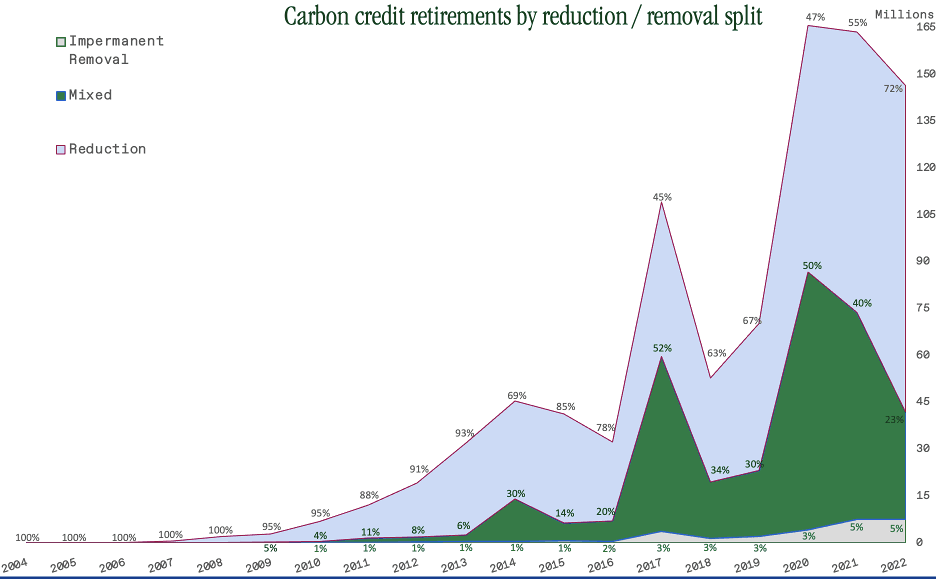

After a sharp increase from 2019 to 2020, carbon credit retirement rates are holding steady at around 150-160 million credits (tonnes of CO2) per year.

Carbon credit issuance by type and year; from the Berkeley Voluntary Registry Offsets Database v7

Carbon credit issuance by type and year; from the Berkeley Voluntary Registry Offsets Database v7

This suggests that the rapid growth from 2016 to 2020 has paused for a while - but also, that the market has potentially reached a new equilibrium state of higher demand.

Furthermore, it’s interesting to observe the difference in retirements between different types of credits. We see the biggest decline in the “mixed” category (remember, these are credits related to land use - forest and farm management, etc).

At the same time, impermanent removal credits (primarily afforestation, as you recall) have stayed at the same level as 2021, which is the highest they’ve ever been).

And the reduction credit type has actually grown - quite possibly due to a substitution effect, as fewer mixed-type credits on the market drove buyers towards cheaper, more questionable reduction-type credits. Alternatively, it might be that holders of these credits are using them up faster than before because they believe their value might drop further.

What do we expect from 2023?

This year, the voluntary carbon market is likely to be influenced by a few key trends:

Flight to quality

Increasing criticism of avoidance-type credits is likely to decrease their popularity with potential buyers, who fear facing accusations of green-washing.This is likely to reduce the issuance and retirement of these credits, while putting more pressure on the supply of removal-type credits.

Price polarisation

As quality becomes more a keyword, we can expect impacts on price. In particular, we would expect to see a polarised distribution: credits perceived as low-quality will have their prices coalesce in the <$10/tonne range; while higher quality credits are more likely on offer at >$30/tonne.

Emphasis on transparency and trackability

While the blockchain hype of 2021/ first part of 2022 has died down a bit, the core issue of transparency and traceability in the voluntary carbon market persists. In 2023, we expect new strides in MRV and industry standards for making project info more broadly available. And who knows, blockchain might be back in vogue by the end of the year.

Arbonics connects landowners and credit buyers at scale to remove carbon and protect biodiversity through data-backed forestry solutions.

Our leading technology finds the best strategies to maximise carbon removal, allowing us to offer two solutions to landowners: Afforestation for planting new forests, and Impact Forestry for improved forest management.

We provide credit buyers with high-quality carbon credits from these projects to support your positive environmental impact. Our solutions are backed by advanced technology, deep forestry expertise, and the stringent forestry regulations of the EU.

Interested in buying credits? Introduce yourself here and we will be in touch! Follow us on LinkedIn, Facebook, and Instagram for latest news.

- Carbon credit issuances (i.e. new carbon credits generated)

- Why care how many and what type of credits were issued in a year?

- Why might these types of credits see a decline in issuance?

- What are carbon credit retirements?

- What happened to carbon credit retirements in 2022?

- What do we expect from 2023?

- Flight to quality

- Price polarisation

- Emphasis on transparency and trackability